Investment Strategy The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The investment seeks to provide investment results that, before expenses, generally correspond to the price and yield performance of the S&P 500 Index. The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500 Index. SectorIndustryMarket CapRevenue FinanceFinance - Publicly Traded Investment Trusts$397.168B$0.000B Standard and Poor's Depository Reciepts trust is involved in the financial services industry. Their holdings are comprised of the 500 stocks in the S&P 500 Index, which is designed to capture the price performance of a large cross-section of the U.S. publicly traded stock market.

Monday looked set to be a down day finally for the equity market and for the SPY stock, but an afternoon rally made sure that the record-breaking run of breaking records continues. When you look back to the 1990s it does set some worrying precedents as that eventually gave way to the Dot-Com crash. There are some worrying stretched valuations in evidence in the current cycle, but it does not look like time to step off the train just yet.

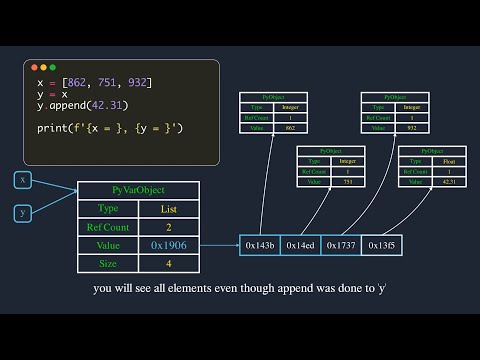

The global backdrop of ultra-loose fiscal policy, money printing and negative interest rates offers a strong backdrop to equities. With little alternative offered by other asset classes, the money just keeps flowing into equities. Added to this backdrop has been stellar results from another earnings season, and companies and households awash with cash having hoarded it during the pandemic. Households are splurging on cars, renovations and investments, while companies are splurging on M&A, SPACs and now buybacks. Most companies were in a blackout period during earnings season but are now free to go back into the market and buy back shares. Stock Spy's unique NewsChart technology makes it easy to see correlations between stock news and stock price activity directly on the stock chart .

This is extremely useful for finding catalysts for short and long term trends. "Cause-and-effect" analysis is literally dead easy when you see the news plotted together with the stock price. This means it's easy to quickly bring yourself up to speed on what is happening in a new potential investment.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +25.60% per year. These returns cover a period from January 1, 1988 through June 28, 2021. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. NewsChart technology shows you how the news volume changes over time.

As you flick through the news articles the NewsChart highlights the currently active bar for the visible news items in the news list. This means if you find a day which had interesting price change you can easily find out what news was "driving" the stock. We have taken this great innovation we call NewsCharts from Stock Spy for the desktop (available on PC + Mac! See more details at Stock-Spy.com) and brought it to the iPad! You always have access to NewsCharts with a large chart filling the right side of the screen and a smaller NewsChart above the news list for when you're viewing web content on the right panel.

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Stock Spy monitors several stock market RSS feeds and combines them with the latest stock values. It can suggest possible share purchase targets or when to sell, according to the latest market movements. The application can deliver results to your computer via a ticker, which organizes information through symbols and signs according to whether it's stocks or shares that it's reporting on. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. GuruFocus.com is not operated by a broker, a dealer, or a registered investment adviser. Under no circumstances does any information posted on GuruFocus.com represent a recommendation to buy or sell a security. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations.

The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. Past performance is a poor indicator of future performance. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. The gurus listed in this website are not affiliated with GuruFocus.com, LLC. Stock quotes provided by InterActive Data.

Fundamental company data provided by Morningstar, updated daily. When we look at the 30-minute chart, the rejection of lower prices straight from the open is not too surprising. The recent volume profile shows volume skewed predominately toward the top of the daily range. $442.37 was the point of control for the month of August so far. This is the price with the maximum amount of volume, and as such it acts as an equilibrium. The SPY traded down to test it early in Monday's session, but buyers swiftly stepped in.

Currently, the intraday support is at $445 from the August volume profile with Monday's point of control at $446. Once you Try Stock Spy we think you'll agree that it's a groundbreaking investor tool which unleashes the potential hidden within stock news. Stock Spy enables you to easily visualize and pinpoint important company events directly on a stock chartto make smart investment decisions, faster! You can quickly see where a stock has been, where it's going and why. It gives you the edge, whether you are a professional trader, an individual investor or brand new to the stock market. Of course, it's next to impossible for average investors to perfectly replicate the S&P 500's exposure by purchasing stock in each of the index's 500 firms.

Enter ETFs – simple, cost-effective vehicles that allow investors to "buy the index" with the push of a button. Even Berkshire Hathaway (BRK.B) CEO Warren Buffett believes most investors should just buy and hold an S&P 500 fund. Is more fully representative of "the market." The S&P 500 gives greater weight to companies with the most value trading in the market.

This makes no logical sense, as UnitedHealth shouldn't be given multiple-times more influence than Walmart , simply because it trades for more than $409 a share and Walmart just $140. The S&P 500 weights them about the same, as they're both valued at roughly $390 billion. If you trade your shares at another time, your return may differ. Cboe pioneered listed options trading with the launch of call options on single stocks in 1973. Today, Cboe is the largest U.S. options market operator supporting options trading on thousands of publicly listed stocks and exchange-traded products .

Cboe's stock and ETP options are SEC-regulated securities that are cleared by the Options Clearing Corporation, and offer market participants flexible tools to manage risk, gain exposure, and generate income. StockInvest.us is a research service that provides financial data and technical analysis of publicly traded stocks. All users should speak with their financial advisor before buying or selling any securities. Users should not base their investment decision upon StockInvest.us. By using the site you agree and are held liable for your own investment decisions and agree to the Terms of Use and Privacy Policy.Please read the full disclaimer here. The live SPDR S&P 500 ETF tokenized stock FTX price today is $452.42 USD with a 24-hour trading volume of $22,656.39 USD.

SPDR S&P 500 ETF tokenized stock FTX has no change in the last 24 hours. The current CoinMarketCap ranking is #4170, with a live market cap of not available. Stock Spy does exactly that by monitoring the latest business news with the latest stock market fluctuations which, in theory, should give you an accurate readout of the latest stock trends.

In reality of course, not all news affects the stock markets and not all news is even necessarily true so the results can be quite erratic. The Barchart Technical Opinion widget shows you today's overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating.

After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. StockSpy supplies a full RSS feed control panel to enable easy customization of the feeds which are associated with each company symbol.

This opens up huge number of possibilities such as feeding search results from web search engines, feeds directly from website of the company you're tracking, or any financial blog which offer feeds. For example, it's simple to add a custom news feed of a competing company to see how the actions of the competition affect a stock's price. StockSpy constantly keeps news updated so you always have the latest and most time-critical information. Top money managers and hedge funds realize the importance of stock news. But most investors are missing out on opportunities to make phenomenal profit from the news. Or even worse, they can't track the news in their current investments!

The reason investors don't take advantage of the news is obvious - It's too hard! It can be very difficult to keep up to date and understand the importance of the news. The Standard & Poor's 500 index is one of the stock market's most widely followed benchmarks because it is comprehensive, diversified and fairly easy to understand. The S&P 500 tracks the shares of 500 large, predominantly U.S-domiciled companies that trade on the major American exchanges. With StockSpy HD you can automatically load several top quality RSS news feeds for each of the symbols you're tracking. This provides you with more complete information when making your important investment decisions.

Stop losing money because you're not getting all the important news & information about your stocks. Say goodbye to wasting time by manually checking several news websites and still not getting the whole picture on your stocks. Start making more money because you have the information to make smart trades.

Short Interest The total number of shares of a security that have been sold short and not yet repurchased. Change from Last Percentage change in short interest from the previous report to the most recent report. Percent of Float Total short positions relative to the number of shares available to trade. The S&P 500, created in 1926, tracks the rise and fall of the largest 500 stocks trading on U.S. exchanges.

And the S&P 500 is widely seen as the definitive measure of the U.S. stock market among most investors due to its superiority to rivals. The SPDR S&P 500 ETF Trust offers investors an efficient way to diversify their exposure to the U.S. equity market without having to invest in multiple stocks. Therefore, SPY is suitable for any investors who want to include U.S. equities in their portfolio while taking only a moderate level of risk. The SPDR S&P 500 ETF Trust is structured as aunit investment trust, which is a security that is designed to purchase a fixed portfolio of assets. SPY is listed on the New York Stock Exchange's Arca Exchange, and investors can trade this ETF on multiple platforms.

The trustee of the SPDR S&P 500 ETF Trust is State Street Bank and Trust Company, and its distributor is ALPS Distributors Incorporated. Because ETFs trade like stocks at current market prices, shareholders may pay more than a fund's NAV when purchasing fund shares and may receive less than a fund's NAV when selling fund shares. An annualized yield that is calculated by dividing the net investment income earned by the fund over the most recent 30-day period by the current maximum offering price that does not account for expense ratio waivers. The weighted harmonic average of current share price divided by the forecasted one year earnings per share for each security in the fund. Negative and positive outliers are included in the calculation.

The market value of a mutual fund's or ETFs total assets, minus liabilities, divided by the number of shares outstanding. The Trust seeks investment results that, before expenses, generally correspond to the price and yield performance of the component common stocks of the S&P 500 Index. In general the ETF tends to have very controlled movements and with good liquidity the risk is considered very low in this stock.

During the last day, the ETF moved $1.57 between high and low, or 0.35%. For the last week the ETF has had a daily average volatility of 0.53%. CM-Equity is fully regulated in Germany, and is a licensed financial institution permitted to offer such products. All FTX users who trade tokenized stocks may also have to become customers of CM-Equity, and pass through CM-Equity's KYC and compliance.

Furthermore, all trading activity may be monitored for compliance by CM-Equity. CM-Equity custodies the equities at a third party brokerage firm. The stock market showed no signs of slowing down this summer and many investors are growing cautious over what will happen in September.

The majority of Wall Street is still very bullish on US stocks as there is just too much liquidity. Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions.

FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.